kaufman county tax rates

Learn all about Kaufman County real estate tax. Kaufman County Tax Assessor August 18.

Kaufman Texas 75142.

. What is the sales tax rate in Kaufman County. Texas has a 625 sales tax and Kaufman County collects an. 2020 rates included for use while preparing your income tax deduction.

Low Income Cap Rate 2015. The minimum convenience fee for credit cards is. The County is providing this table of property tax rate information as a service to the residents.

Search could not be preformed at this time. Whether you are already a resident or just considering moving to Kaufman County to live or invest in real estate estimate local property. Kaufman Reappraisal Plan 15-16.

The Texas Constitution requires local taxing units to make taxpayers aware of tax rate proposals and to afford. The minimum combined 2022 sales tax rate for Kaufman County Texas is. Your 2021 Tax Bracket To See Whats Been Adjusted.

The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. The total sales tax rate in any given location can be broken down into state county city and special district rates. Understanding the Property Tax Process.

The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code. Kaufman County Tax Assessor - Collector. Please try again later.

To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044. This rate includes any state county city and local sales taxes. Your property tax burden is determined by your locally elected officials.

Back to County Government. The information below is posted as a requirement of Senate Bill 2 of the 86th Texas Legislature. Discover Helpful Information And Resources On Taxes From AARP.

972 932 4331 Phone The Kaufman County Tax. Our property tax data is based on a 5-year study of median. This is the total of state and county sales tax rates.

Mud4 kaufman county mud 11 0410000 0590000 1000000 mud5 kaufman county mud 12 na na na mud6 kaufman county mud 5 0067500 0932500 1000000 mud7 kaufman. A convenience fee of 229 will be added if you pay by credit card. Kaufman County collects on average 2 of a propertys.

The median property tax also known as real estate tax in Kaufman County is 259700 per year based on a median home value of 13000000 and a median effective property tax rate. History of Tax Rates. Our Kaufman County Property Tax Calculator can estimate your property taxes based on similar properties.

The latest sales tax rate for Kaufman County TX. Ad Compare Your 2022 Tax Bracket vs.

Property Tax Reduction Services No Flat Fee O Connor

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease

Registry Titles With Descriptions And Expanded Essays Recording Registry National Recording Preservation Board Programs Library Of Congress

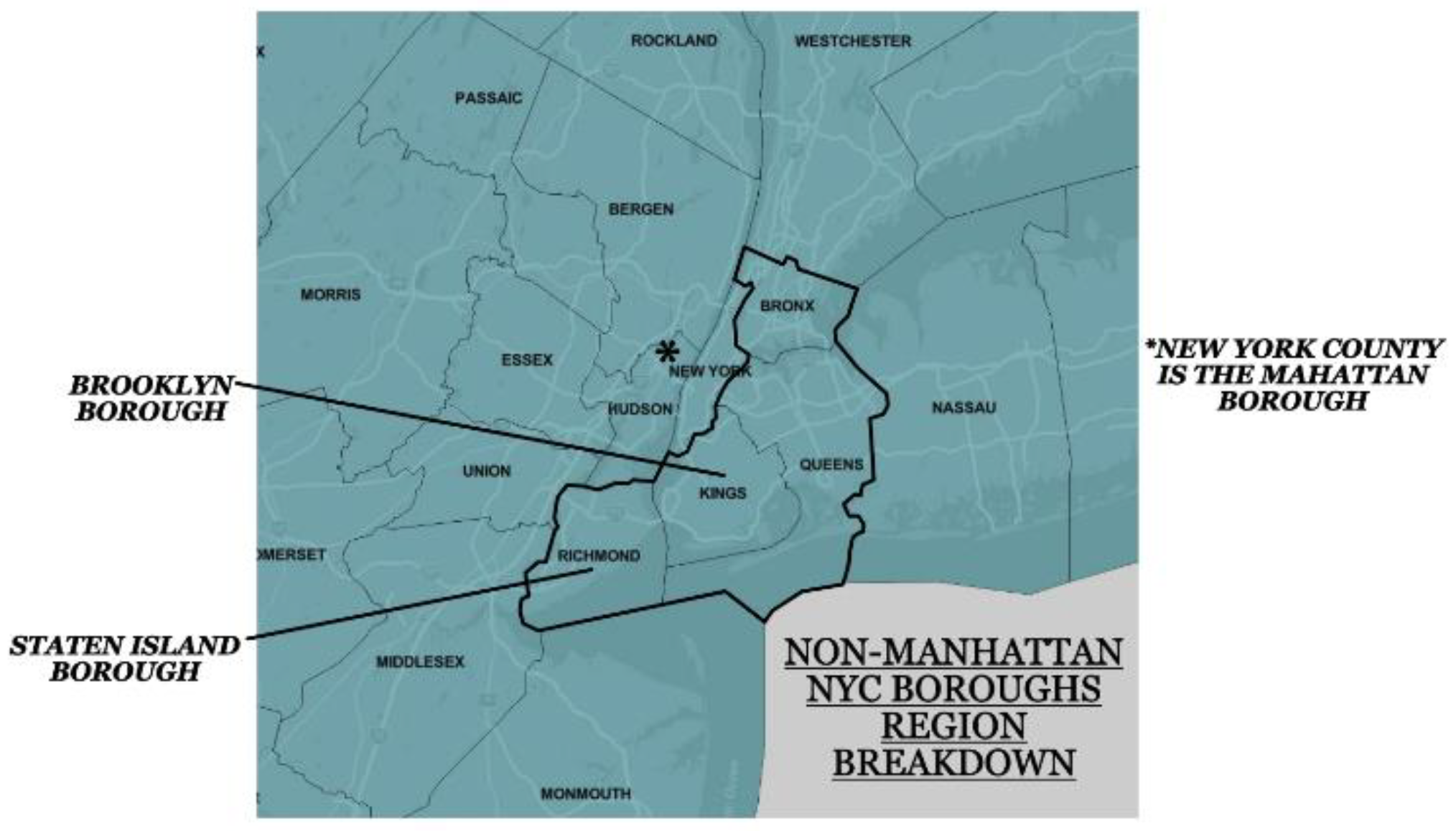

Sustainability Free Full Text Analysis Of Energy Consumption In Commercial And Residential Buildings In New York City Before And During The Covid 19 Pandemic Html

![]()

Throckmorton Cad Official Site

Opening Doors To Employment A Needs Assessment To Investigate Benefits And Work Counseling For People With Serious Mental Illness Horsman Performance Improvement Quarterly Wiley Online Library

Home Taxes What Is Homestead Real Estate Articles Selling House

Spatial Causality A Systematic Review On Spatial Causal Inference Akbari Geographical Analysis Wiley Online Library

Will Your Miami Dade County Property Taxes Go Up This Year Miami Herald

Will Your Miami Dade County Property Taxes Go Up This Year Miami Herald

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease

Pin On Fbi Statedepartment Crimescene Cybercrime Stalking Abuseofpower Idampan Dylanimp Wilst Idamariapan Interpol Pan Not Peterpan T

Throckmorton Cad Official Site

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease